Asset.Desk Lifecycle management

Cost allocation

Asset.Desk Lifecycle Management add-on module "Service Allocation".

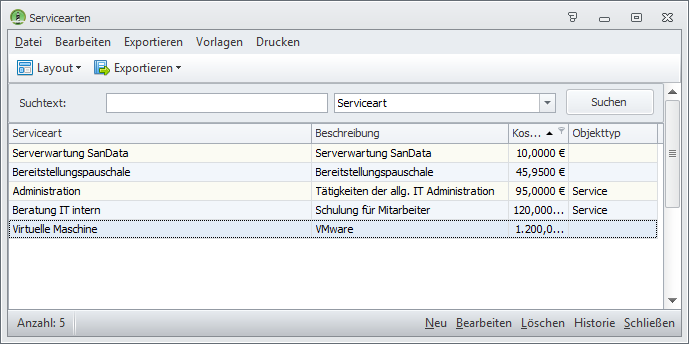

Each IT department provides services and services (services) to the business units of your company. With Asset.Desk you can summarize these services in a service catalogue, price them and, if necessary, charge them within cost centers or your company structure.

By debiting the user's cost centers and relieving the collective cost centers (double posting), the IT department providing the service can be identified as a profit center.

Price lists can be defined for transfer prices. Additionally or alternatively, fixed recurring transfer prices can be used.

Possible service price allocation between cost centers

One-off costs, e.g. B.

- Acquisition costs for IT resources

- License costs for managed software

Recurring costs, e.g. B.

- Hardware maintenance costs

- Regular leasing rates

- Cost of Consumables

- Services for infrastructure and helpdesk

- Depreciation costs

ITIL-compliant multi-level billing

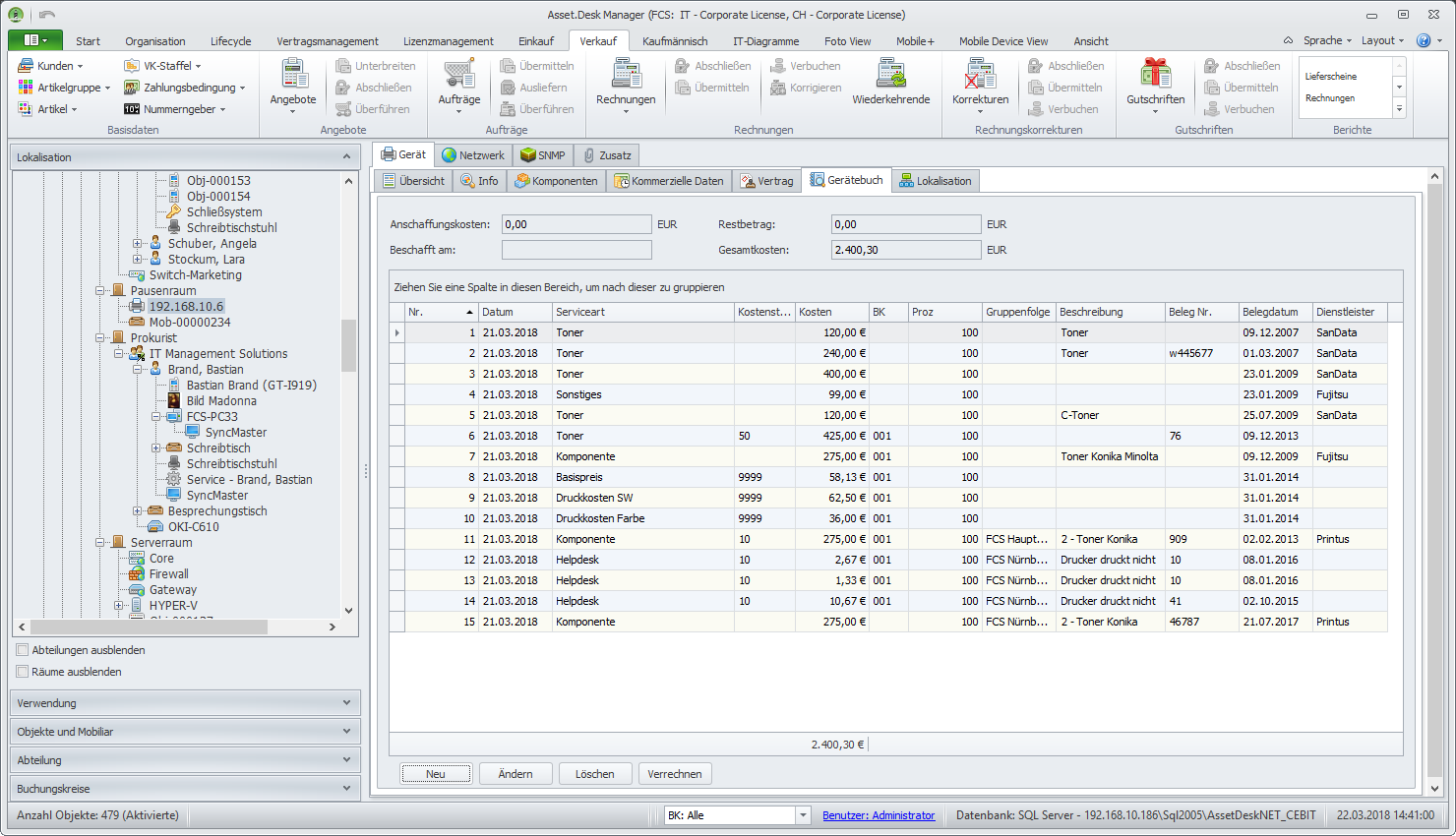

In the first step, the costs of the IT resources responsible (e.g. mail server and switch) are charged to the cost center of the service (e-mail service) in full or in part.

In the second step, this service is then sold to the users at a fixed price. The balances of the IT cost centers are always shown transparently in order to check how economically the cost centers are working and whether the prices charged are appropriate.

Internal clearing can be done in Asset.Desk automate so that you only have to make the settings for prices and billing cycles once. Of course, individual bookings are also possible at any time.

We would also be happy to advise you on integration into your enterprise application environment.

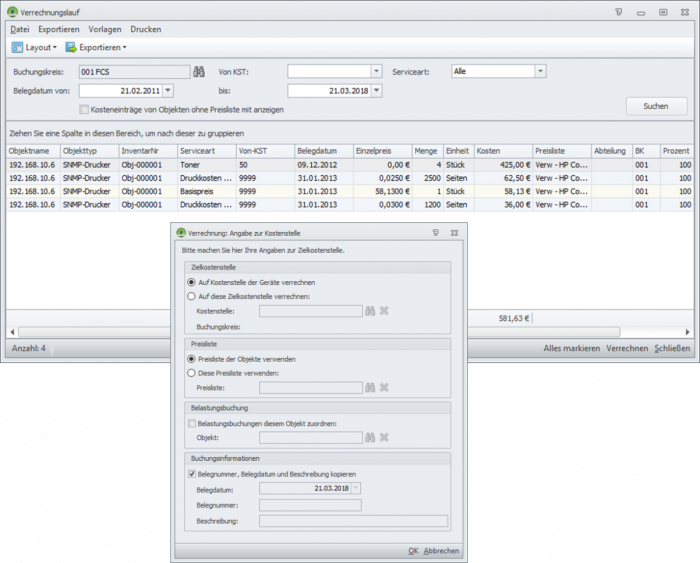

Asset.Desk offers several billing types

Costs for services can be offset from one source cost center to one or more target cost centers via freely definable price lists. A price can thus be specified for each type of service that is to be charged. A price list is assigned to each IT resource (device or service) to be billed in this way.

The billing can take place at any point in time – retrospective billing is also possible.

In the second variant, recurring costs with a billing period are assigned to the target cost center for each service type. Month, quarter, half year or year are available as billing periods.

In contrast to price lists, the costs are assigned directly here: the debiting of the target cost center results from the recurring costs assigned to it. There is also the option of triggering a credit to the source cost center.

Complete mapping of the internal billing of IT services

These include:

- Entry and maintenance of services in the service catalogue

- Cost recording on cost centers per service type

- Billing of services between cost centers

- Debit and credit postings

- Identification of costs per cost center, service type and IT resource

Asset.Desk Try it for free or buy it directly!

Asset.Desk you can test it for free at any time.

You are welcome to request a non-binding offer or a personal online demonstration.